SSDI Back Pay

If you cannot work due to a disability, making up for your loss in income is an immediate priority. Most people know their disability may make them eligible for monthly Social Security Disability Insurance, or SSDI, benefits checks. However, many aren’t aware they may also be eligible to receive a lump sum of SSDI back pay dating back to the date they applied for benefits— or even as far back as their diagnosis date.

Video Transcript

Retroactive benefits or payments for SSDI refers to the benefits owed to you from the time you became disabled, the established onset date, to the time your claim is approved. These payments are different from back pay, which is the amount owed from the time you applied to the time the claim is approved. Retroactive payments cover a period before you even apply under special conditions.

This is how retroactive payments work, generally speaking. Social Security determines the date when your disability began. This is referred to as known as the established onset date.

This is based on medical evidence and can sometimes be earlier than the date that you applied for Social Security Insurance. You also have the application date. When you apply for SSDI, SSA allows you to receive retroactive payments for up to 12 months before your application date, but only if your disability began before this date.

This means that under certain circumstances, you could receive retroactive payments for the time between the onset of your disability and the application date up to one year. Now, Social Security has a five-month waiting period. Once you receive and are awarded benefits, SSDI has a built-in five-month waiting period from the established onset date, during which no benefits are paid.

For example, if SSA determines that your disability began eight months before you applied, you would be eligible for three months of retroactive benefits after accounting for the five-month waiting period.

- SSDI back pay compensates for the months a person was eligible for benefits but did not receive payments due to application processing delays.

- The amount of SSDI back pay is calculated based on the application date, disability onset date, and the five-month waiting period.

- Retroactive SSDI payments can include up to 12 months prior to the application date if eligibility criteria are met.

- Receiving back pay often involves a lump sum payment, which can significantly help with financial stability for those waiting on SSDI benefits.

If you meet the criteria for SSDI approval, you’re likely also entitled to SSDI back pay. A disability attorney can help you understand your rights and advocate for you to receive every penny you’re owed in SSDI benefits.

What Is SSDI Back Pay?

Back pay is money you’re owed from the time you become eligible, based on your disability application date and the established onset date, until your claim is approved.

- For SSDI, back pay starts after the 5-month waiting period to the date of approval.

For SSI, back pay begins the month after your application date, no matter when you became disabled.Back pay is a combined amount of monthly SSDI benefits—issued as a lump sum—to compensate you for the time you spent waiting for your SSDI application to be approved. Most SSDI applicants struggle with finances while waiting for benefits due to their inability to work. Back pay is intended to make up for the lost benefits.

Back pay is paid at your standard monthly benefits rate, covering the period from when you first applied for SSDI up to your approval date. This period has no time limit, and you could receive back pay for years’ worth of benefits if your application process took a long time. This usually happens when your claim requires multiple appeals.

What Are Retroactive Benefits (SSDI Only)?

These are benefits for time before you applied, up to 12 months prior, if:

- You were already disabled during that time and

- You had enough work credits during that earlier period.

- SSI does not offer retroactive benefits.

You can also receive a retroactive payment for up to 12 months of benefits if you show that your disabling condition existed before you filed your application. This retroactive payment compensates you for the period when you would have been eligible for SSDI benefits but had not yet applied for them. This period begins on the established onset date, or EOD, of your disability.

| Term | SSDI | SSI |

|---|---|---|

| Back Pay | Yes – Covers time after you apply but before you’re approved | Yes – Begins month after you apply |

| Retroactive Benefits | Yes – May cover up to 12 months before you applied | Not available – SSI does not pay for time before your application |

| 5-Month Waiting Period | Yes – SSDI benefits start 5 full months after disability onset | No waiting period for SSI |

| Payment Type | Lump sum, usually one check | Installments, if back pay is large |

How Does SSA Determine My Established Onset Date?

Several factors go into determining your EOD, especially if your disabling condition did not result from a single incident but rather developed gradually, with symptoms emerging over time. Common dates used by SSDI applicants to determine their onset date include the diagnosis date, a hospitalization date, or the day they stopped working. SSA focuses on the date you stopped working, the date last worked for the onset date.

The onset date submitted by an applicant is called the alleged onset date, or AOD. When the SSA determines that the AOD is accurate or finds that a different date is correct, that date becomes the EOD.

Understanding How Social Security Decides the Disability Onset Date

1. What Is the Alleged Onset Date (AOD)?

The alleged onset date is the date you tell Social Security you became too sick or disabled to work. This is the starting point SSA uses when looking at your case, but they still have to verify it with other evidence.

2. What Happens If You Worked After Your AOD?

Social Security will look at whether you kept working after the date you said you became disabled. If you did, they will decide whether that work was:

- Substantial Gainful Activity (SGA) – meaning you earned enough to suggest you were not disabled yet, or

- An Unsuccessful Work Attempt (UWA) – meaning you tried to work but had to stop shortly after because of your condition or loss of special help you needed.

If your work after the AOD counts as SGA, your disability onset date may be pushed to the time you stopped working. But if SSA agrees it was an unsuccessful attempt, they may still use your earlier AOD.

3. How Does SSA Use Medical Evidence?

SSA needs medical records to support your disability claim. This includes:

- Doctor’s notes and reports

- Test results and imaging

- Hospital records

- Notes from mental health treatment

- Consultative examinations

The medical evidence should show when your condition or impairment became severe enough to stop you from working.

4. Other Types of Helpful Evidence

Besides medical records, SSA may also consider:

- Your age, education, and work experience

- Statements from people who know you well—family, friends, neighbors, past coworkers or employers—about how your condition affected your ability to work

These sources help SSA fill the gaps, especially when records are limited or unclear.

5. If Disability Was Caused by a Sudden Event (Traumatic Origin)

If your disability was caused by something sudden like:

- An accident

- A stroke

- A heart attack

SSA usually sets your onset date as the date of the event, as long as:

- Your condition is expected to last at least 12 months, or result in death, and

- You didn’t return to substantial work after the event

Even if you worked on the day of the trauma, that doesn’t affect your onset date.

6. If Disability Developed Over Time (Non-Traumatic Origin)

For conditions that worsen gradually, like:

- Multiple sclerosis

- Degenerative arthritis

- Depression

- Fibromyalgia

…it can be harder to pin down the exact day your condition became disabling. In these cases, SSA will look at all available evidence, including:

- Your medical history

- The nature of your condition

- Statements from you and others about how your health changed over time

- Past work records

SSA may need to infer the onset date, especially if your records are incomplete or from long ago.

7. What Is the Actual Disability Onset Date (EOD)?

SSA decides your established onset date (EOD) based on when the evidence shows your condition became severe enough to prevent you from working for at least 12 months or result in death.

8. Special Rules and Guidance

- Social Security Ruling 84-25 helps SSA decide if a work attempt should count as an unsuccessful work attempt (UWA).

- Social Security Ruling 18-1p and 18-2p (blindness) guides decisions about onset dates when the condition developed over time.

- Sometimes SSA or the DDS may refer the case to a Medical Consultant for help determining the correct onset date.

Experienced disability attorneys and advocates with deep knowledge of onset-related issues can make a powerful difference in your case. They know how to gather and present the right medical and vocational evidence to support the earliest possible disability onset date—maximizing your back pay and retroactive benefits. With personalized and superior guidance, your claim is positioned for the strongest possible outcome. Contact us today to see if we can help today.

How Far Back Can Back Pay Go?

Back pay between the date of application and the approval date is functionally unlimited. You can receive back pay for as many months as it took the SSA to approve your application after you filed it.

However, you can only receive up to 12 months of retroactive payments dating back to your EOD, no matter how long you were disabled before applying for benefits. If you became disabled in January of 2023 but applied for benefits for the first time in January 2025, you could not receive retroactive payments for time before January 2024.

Additionally, back pay doesn’t always reach the 12-month maximum, even if you were disabled for 12 months or more before you applied. The SSA has a five-month waiting period between your EOD and when you become eligible for SSDI benefits. This period is designed to prove that your disability is persistent and truly prevents you from working. Therefore, if you became disabled in January 2024 but did not apply for benefits until January 2025, you could only receive retroactive benefits dating back to June 2024 because you were not eligible for SSDI for the year’s first five months.

How Is SSDI Back Pay Calculated?

To determine the amount of your SSDI back pay, you must consider the amount of time since your application and the amount of time since you originally became disabled.

The amount of time since you filed your application is considered in full, with no subtractions. If it took 18 months for your application to be approved, you’ll receive 18 months’ worth of monthly payments for that time.

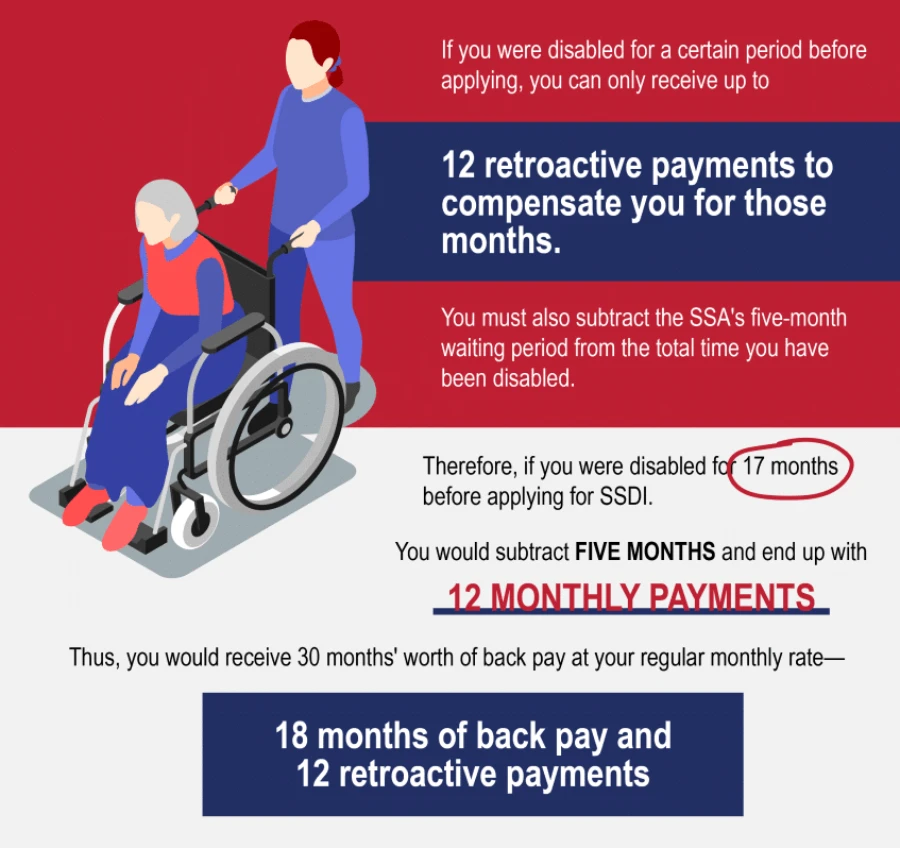

However, if you were disabled for a certain period before applying, you can only receive up to 12 retroactive payments to compensate you for those months. You must also subtract the SSA’s five-month waiting period from the total time you have been disabled.

Therefore, if you were disabled for 17 months before applying for SSDI, you would subtract five months and end up with 12 monthly payments. Thus, you would receive 30 months’ worth of back pay at your regular monthly rate—18 months of back pay and 12 retroactive payments.

Your SSDI monthly payment amount is calculated based on your earnings and other circumstances. To estimate your monthly payment, check out the SSDI calculator tool.

How Long Does It Take To Receive SSDI Back Pay?

Once approved, the time it takes to receive SSDI back pay varies based on the circumstances of your case and your state residence where the claim was filed. Currently, it takes from 175 to 287 days to receive an initial determination depending on where you live.

After the approval, your claim is sent to a payment service center for effectuation or processing. In a recent study, it was found that most SSDI awards are effectuated within a week of the determination, while the time for SSI awards grew from 20 days in 2014 to 77 days in early 2023. However, some cases took far longer to effectuate for both types of benefits.

You will receive the back pay as a lump sum on your first check.

Does Back Pay Get Taxed?

SSDI back pay lump sums are taxed according to the same rules as standard monthly SSDI payments. Thus, your SSDI back pay may be taxable, depending on your income.

If you earn less than $25,000 annually and are single, married filing separately, the head of household, or a qualifying widow or widower, your SSDI benefits are not subject to tax. This threshold increases to $32,000 if you are married filing jointly. These rules apply to both back pay and monthly payments.

If you earn more than these amounts, your SSDI benefits are taxed at either 50 percent or 85 percent, depending on your income. Your back pay is taxed at the same rate. However, if you receive a lump sum of back pay, you must declare the entire sum in the year you received it.

You cannot amend a previous tax return to reflect back pay, even if part of the lump sum technically applies to the previous year. The IRS does allow you to make tax calculations using the previous year’s income, which may decrease your liability if your previous income was lower. You can calculate your benefits tax liability using the steps listed on our website.

Disability Advice Can Help Maximize Your Back Pay

Applying for disability benefits and waiting for approval is a long and difficult process. Disability Advice can connect you with a skilled disability attorney who can advocate for you and assist you in submitting the best application or appeal possible.

Whether you’re applying for the first time or appealing a previous denial, you have options—and you might be owed more money than you think. Disability Advice is here to help. Contact us todayto see if we can help today.

“The person I spoke with was very knowledgeable and very thorough with answering all of my questions and making sure all my information was correct. He was very patient, kind, and was very helpful. I wasn’t sure if I would qualify, and he checked and took all of my information. The process was made very easy, thank you so much for your help.”

“I was very nervous about reaching out for help with disability benefits. This experience was so much easier than what I thought it would be. They were understanding and supportive, and answered all of my questions. I would highly recommend them.”

“I had a great experience with my representative. She was very friendly and she made the process very easy. I’m glad I had the pleasure to work with her in filing my claim. She provided great customer service.”

“Professionalism at its best. From intake to getting my claim started, they are the ones you need. 100% recommend to everyone.”

“Having never gone through this process before, it was very easy and straightforward. VERY professional and polite.”

“One of the best customer service experiences I have ever had. Patient and kind and couldn’t of made my experience better. Thank you for all the help.”